Revenue, profit, and margin topics are heavily analyzed and frequently scrutinized in all manufacturing organizations. Sales analysis is an age-old concept in business and one that is increasing in focus as manufacturers gain greater exposure to advanced ERP and Business Intelligence software. Big data analytics has become all the rage, and what better data to analyze than sales, right? Well, not entirely.

Sales analysis, while critical for developing performance metrics, is the end of a chain. By the time sales analysis informs you of poor performance within a product or product line, it is too late to rectify the issue. Additionally, sales analysis will only tell you that a problem occurred, potentially quite some time ago, and will often give you little to no indication as to when, where, why, or how.

The data that could have notified you trouble was coming, was captured earlier in the purchasing and/or production transactions. Understanding and analyzing variance within the purchasing and production areas is essential to developing accurate product costing and making decisions on expanding or eliminating different product lines or areas of business.

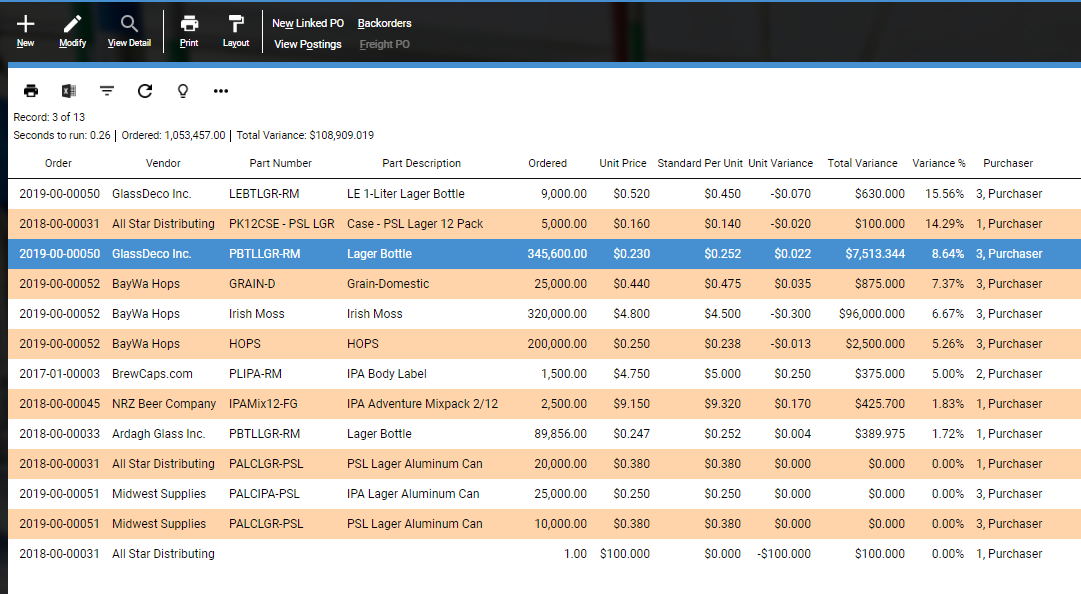

Purchasing Variance Reporting

When it comes to purchasing, cost variance is the key data point to analyze as it affects production costing. Maintaining accurate standard costs, regardless of the cost mode you use, is a necessity for determining purchasing variance. With well-maintained standards, you can perform proactive variance analysis in addition to retroactive analysis. The moment a purchase order is entered, you should be able to determine what your Purchase Price Variance will be. This is done by comparing the purchase order price-per-unit to the standard cost-per-unit of the item being purchased.

Now, long before the delivery arrives on your dock, you have clear visibility to the variance from standard that this purchase order creates. These metrics allow you to track the performance of both your vendors and your purchasing employees against the expectations set by the company when a standard cost was established.

Within the production arena, there are two forms of variance you will need to be concerned with: quantity (yield) and cost. While the former affects the latter, they should both be analyzed to understand if quantity variance was the driver of cost variance or if additional factors, such as increased materials cost, or material waste, were the driver of the cost variance.

Production Yield Reporting

Done within the sub-ledger, this type of reporting analyzes the units consumed through the job against the units produced off the job. Units, as referred to in this article, can be weight, volume, or each. Whichever you choose, the inputs and outputs should be normalized to the same unit to allow for a proper comparison. For this reason, lbs is the most common unit for yield variance analysis.

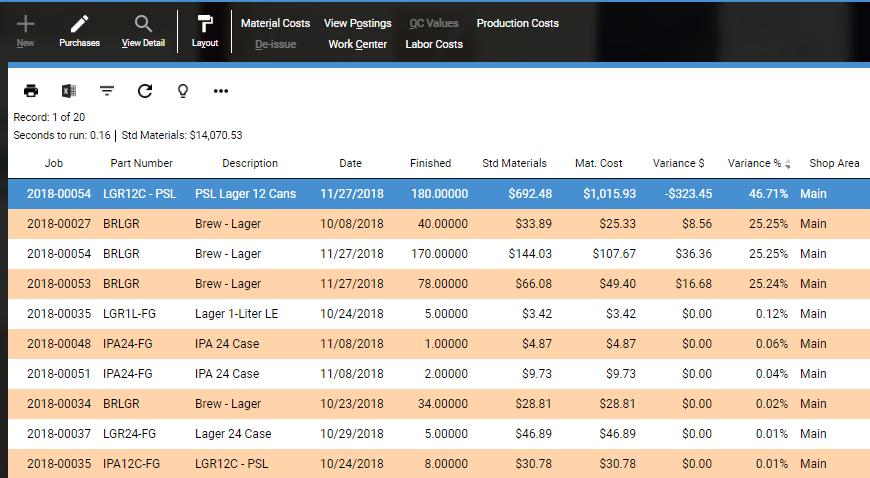

Production Cost Reporting

Production Cost Reporting can, and should, be done at both the ledger and sub-ledger levels of your ERP system. The sub-ledger allows for maximum granularity, while also offering options for higher level management analysis. The sub-ledger reporting is where you go to get the answer on how or why variance occurred. On the other hand, the ledger offers a high-level analysis of reality compared to standard. The control reports, put in place to be alerted when variance has occurred, are built against the sub-ledger. When properly monitored, these reports allow for a process manager to be immediately aware of a variance outside of the allowed tolerance percentage.

Process oversight and data analysis can be found within all organizations. What will set you apart from competitors is by ensuring your analysis is done in the most impactful areas. Establish and actively monitor standard costs and variance tolerance, develop a clear vision of what success looks like, and build the reports to track performance against that vision. Empower your employees with the tools they need to know if the decisions they are making are beneficial to the business. Develop your analytics, challenge the results, continuously refine the metrics you use to measure success and be prepared to react to the information you are gaining from your analysis.