Are you managing your business work center depreciation correctly? If you rely on duplicate and manual data entry, chances are that your answer is “no.”

Properly calculating the depreciation of fixed assets will allow your business to capitalize on one of the IRS’s most valuable tax deduction for manufacturers. Such assets include buildings, furniture, and equipment that have a useful life beyond one year but lose value over time based on wear and tear of the item. The depreciation recovery period varies by asset so it is important to keep tight records to ensure the highest return.

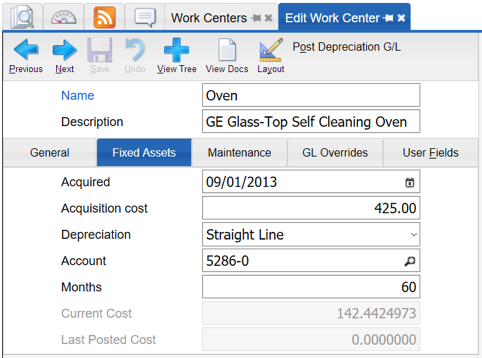

Deacom recently developed a new feature to calculate, manage, and post Work Center depreciations directly in the main ERP application. From any Work Center, accounting team members can keep track of initial acquisition costs and set up asset-specific criteria based on a straight line depreciation. At any point in time, they can run through work centers and post the values to the necessary expense accounts.

By keeping these details within DEACOM ERP rather than a spreadsheet, manufacturers create more reliable records that can be sourced anytime and anywhere.