Just last week, New York-based WeiserMazars LLP released their 2016 Food & Beverage Industry Study shedding light on internal and external concerns of businesses in these industries. These findings identified some of the biggest trends to happen to the Food and Beverage sectors as well as what opportunities have potential to drive maximum growth – a number that is expected to increase 14% over last year.

Just last week, New York-based WeiserMazars LLP released their 2016 Food & Beverage Industry Study shedding light on internal and external concerns of businesses in these industries. These findings identified some of the biggest trends to happen to the Food and Beverage sectors as well as what opportunities have potential to drive maximum growth – a number that is expected to increase 14% over last year.

Perhaps most interesting from these findings are the trends identified as having most impact on sales. Healthy/nutritious options rank highest with 20% response rate from companies with less than $50 million in revenue, followed closely by private label foods (18%), and non-GMO (17%). While large firms (more than $50 million in revenue) rank private label and healthy/nutritious foods as most important, locally grown/produced foods fall not far behind. These numbers express a clear shift in consumer preferences towards more health-focused options.

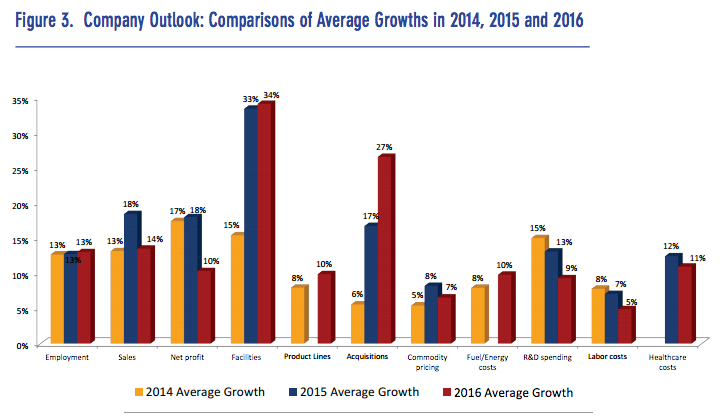

So what do these companies see in 2016? Growth! Not just by employment (13%), Facilities (34%), or product lines (10%), but by acquisitions (27%). In fact, we have already experienced quite a few, significant acquisitions last month alone.

Spam’s parent company, Hormel, is the prime example of a business capitalizing on the opportunities identified in WeiserMazar’s research. Expanding their portfolio with product lines opposite to their flagship, Hormel is able to stay competitive by attracting a trendier consumer base. Examples of these brands include Justin’s LLC, Applegate Farms, and MuscleMilk, all in just the past three years. This strategy has increased Hormel revenue by $3.9 billion over the past decade.

Industry trends shift constantly yet they are huge contributing factors towards the success and failure of a business. If strategically planned for, tomorrow’s “latest and greatest” can skyrocket sales but if you are still coasting on last year’s trend, you may be left in the dust. Research like this can help gain and maintain a competitive advantage.